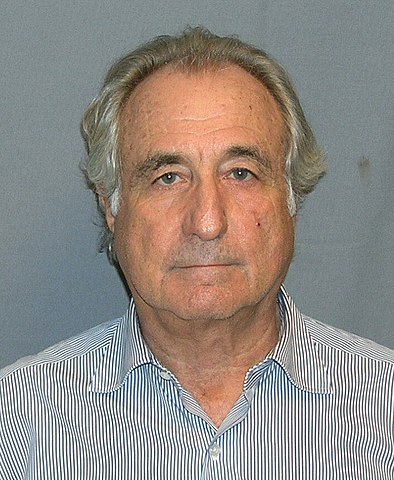

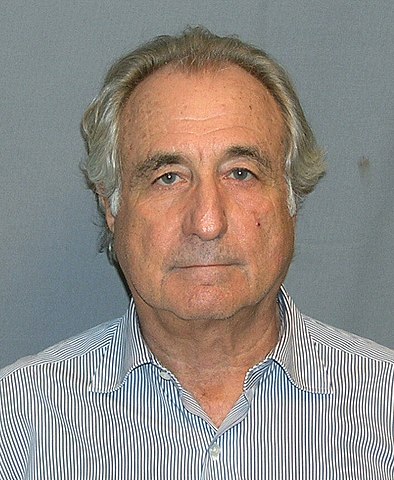

The shocking story behind the biggest swindle in the history of Wall Street.

Agent Cacioppi was so taken aback by Madoff’s candor and unusual cooperation he called his office to determine what he should do next. Typically, a subject with Bernie’s sophistication and community stature would refuse to answer questions and stall, at least requesting time to speak with or even have an attorney present before answering any questions. Madoff’s admissions to the agents were an unexpected response. The agent was told to arrest Madoff and bring him to FBI offices at 26 Federal Plaza.

Upon graduation from college, Madoff briefly attended Brooklyn Law School but unlike his brother Peter, who graduated from Fordham Law School, he dropped out after a year. He did pass the requisite exams to not only sell financial securities but to also operate his own securities brokerage firm, which he formed in 1960, calling it Bernard L. Madoff Investment Securities. By then, Madoff was already married to Ruth Alpern, the daughter of a successful accountant, Saul Alpern. Another occasional fable that Madoff spun was that his working capital came from his summer jobs installing sprinklers and as a lifeguard. He frequently left out the fact that his father in law not only lent him fifty thousand dollars, he also gave him a desk in his firm’s office and referrals of all of Saul’s client base.

By the early seventies, several personal events greatly affected Madoff, the sudden and relatively early death of both of his parents and the inclusion of his brother Peter into his growing business entity. Between July 1972 and December 1974, Ralph and Sylvia would both die suddenly before their sixty-fifth birthdays an event that probably prompted the elder Bernie to take his younger brother under his business wing. Peter was a critical employee who became more operations and technology oriented, helping to keep the firm’s broker dealership on the cutting edge of upgraded technology in a securities market environment that was undergoing a technological revolution. And Peter would also assume the role of chief operations officer, a critical responsibility in any brokerage firm but even more so within Bernard L. Madoff investment securities.

His sons, Mark and Andrew, newly minted graduates of the University of Michigan and Wharton respectively were both now working for the firm, albeit on the broker dealer side of the business.

Avellino claimed that all of the money was there and was in the hands of his money manager, Bernard Madoff. As soon as he had heard of the SEC inquiry, Madoff tried to get ahead of what he knew was coming. Not only an SEC demand for the return of the assets but a possible scrutiny of his trading history to determine whether or not he in fact was running a legitimate money management firm, with ongoing investment in the markets. To do this he tasked one of his employees, Frank DiPascali, the individual who already was involved in producing investor statements that were most likely either distorted if not out right falsified, to reconstruct trades for all of the Avellino and Bienes accounts that would demonstrate the profits necessary to generate the claimed returns. These fictitious trades also had to stand up to SEC scrutiny. Amazingly, Madoff’s conversations concerning his trading strategies and DiPascali’s creation satisfied the SEC, however they did get a court order to force Madoff to return what were illicitly collected funds.

Podcast: Play in new window | Download

Subscribe: RSS